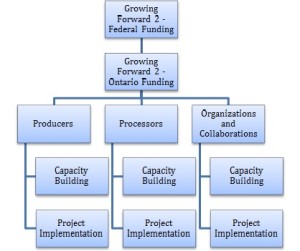

Application for Ontario small business grants through Growing Forward 2 program is now available at the provincial level. This government funding for business is a combination of federal and provincial funds to a total of $417 million over the next 5 years. It is targeted towards the government of Ontario’s objectives for the agriculture industry, including, improving business and leadership skills, adapting to climate change, developing markets and investing in research and innovation for the agriculture industry.

Growing Forward 2 Small Business Grants Streams

Choose from one of the below for more details pertaining to the particular stream you are interested in, each contain an overview as well as eligibility and application process information.

- Small Business Grants for Capacity Building Stream

- Small Business Grants for Project Implementation Stream

Focus of Growing Forward 2 Small Business Grants Streams

These Ontario government funding streams are targeted towards the following applicants:

- Organizations and Collaborations: An Organization is a legal, not-for-profit organization, based in Ontario in the agriculture, agri-food, agri-products industry. A Collaboration is a partnership between any two or more, legal, for-profit business, not-for-profit organizations/associations, and academic institutions.

- Processors: Processors are involved in the processing, modifying or transforming agriculture commodities, food, beverage, or agricultural based bio-products in Ontario; file business and/or farm income/loss taxes in Ontario or are a new processor

- Producers: Producers produce agricultural commodities in Ontario; file business and/or farm income/loss taxes in Ontario; new farmers and first nations farm businesses

Ontario Small Business Grants Project Eligibility

Projects must fit within one of the following focus areas:

- Environment and Climate Change Adaptation

- Animal and Plant Health

- Market Development

- Labour Productivity Enhancement

- Assurance Systems (Food Safety, Traceability and Animal Welfare)

- Business and Leadership Development

Small Business Grants for Organizations and Collaborations

Capacity Building projects include: strategic planning, training, audits or assessments. Funding will be provided, on a cost-sharing basis, up to 75% of the eligible costs, to a maximum of $3 million. For this stream of funding, in-kind contributions are not eligible and priority will be given to those applications that demonstrate a high level of industry-leveraged cash contributions.

Small Business Grants for Organizations and Collaborations Application Process & Deadlines

The small business grants application process involves a Pre-Proposal and a Full Application with deadlines in 2013 of September 5, October 24 and December 12, 2013. Projects must be completed within 18 months of approval.

Growing Forward 2 Small Business Grants for Processors

Capacity Building projects include: strategic planning, training, audits or assessments. Government funding for business will be provided, on a cost-sharing basis, for up to 50% of the project costs.

Growing Forward 2 Small Business Grants for Processors Application Process & Deadlines

The government grants for small business application process for Capacity Building is ongoing and involves one application. During September 9, 2013 to October 24 and December 16, 2013 to January 30, 2014 cost-share opportunities for Project Implementation will be available to eligible processors and new processing businesses. Funding for these projects will be on a cost-sharing basis of 35% or up to 50% of total project costs for innovative projects. More information on the Project Implementation stream for Producers will be available in August.

NOTE: The maximum amount of funding available to a single processing business covering both Capacity Building activities and Project Implementation is $350,000 over the 5-year timeframe of the program (April 1, 2013 to March 31, 2018)

Growing Forward 2 Small Business Grants for Producers

Capacity Building projects include: strategic planning, training, audits or assessments. Government small business grants will be provided, on a cost-sharing basis, for up to 50% of the project costs.

Growing Forward 2 Small Business Grants for Producers Application Process & Deadlines

The application process for Capacity Building is ongoing and involves one application. During September 9, 2013 to October 24 and December 16, 2013 to January 30, 2014,

Project implementation small business government grants will be available to eligible producers and new Ontario farm businesses. Small business funding grants for producers will be available in a cost-sharing arrangement for up to 35% of project costs to 50% cost-share for innovative projects. More information on the Project Implementation stream for Producers will be available in August.

NOTE: The maximum amount of funding available to a single farm business covering both Capacity Building activities and Project Implementation is $350,000 over the 5-years timeframe of the program (April 1, 2013 to March 31, 2018)

Contact a Growing Forward 2 Small Business Grants and Loans Expert

If your agricultural business has at least 15 employees and has been incorporated for at least 3 years get in touch with a Canadian government funding expert for more information about these and other small business grants and loans for agriculture. Also, please follow us on LinkedIn and sign up for our Canadian small business grants and loans e-newsletter in order to stay up to date on all things related to Canadian government funding for agriculture.

Views: 471

Comment

© 2025 Created by Darren Marsland.

Powered by

![]()

You need to be a member of Ontario Agriculture to add comments!

Join Ontario Agriculture